There are two roles in an IPO or equity financing of a company: underwriter and investors. As an average investor myself, it is impossible to guess what other institutional investors are up to. However, one thing I know for sure is that underwriters take fees and want to off load risks as soon as possible.

I hope you can utilize this article to make guaranteed money for yourself. Don’t forget to share the article or donate back to me if you do! Haha just kidding.

First let’s understand the process.

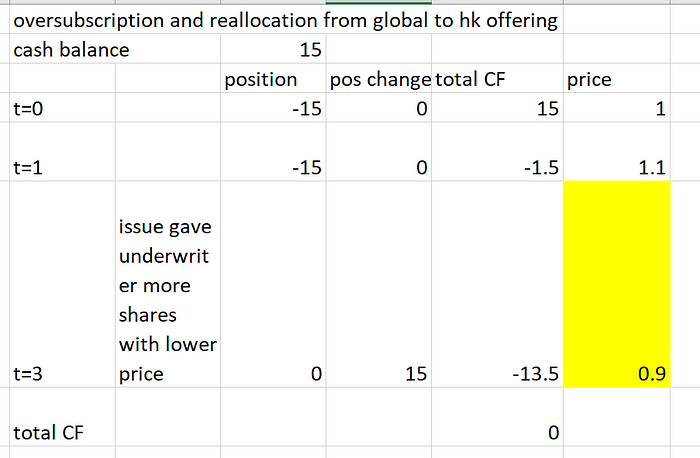

For very popular stocks, there is less risk for the underwriters. Shares are very easy to sell. Companies seek the more prestigious institutions, as long as the price to cover green shoe option is reasonable (highlighted in yellow). There should be guaranteed underwriting fee with minimum position risk for the syndicate.

Second scenario is where we make the money: undersubscription.

Let me explain using a simple example before delving in a real world one. Here the underwriter is forced to take 100 stock position so starting with -100 cash. When share price drops on the IPO date, the underwriter will exercise the over-allotment option to buy at the current price, and later return the same extra 15% shares to the issuer with agreed “green shoe price”. In order for the cash flow to remain 0, the “green shoe price” had to be 77% haircut. Finally, the underwriter hope the price will go up after the over-allotment buy and offload the position at somewhere higher than the listing price.

Let’s see a real world example, a famous Chinese education company called new oriental. HKEX Filings | New Oriental Education and Technology Group, Inc.

Initially the issue price after road show was 1399 HKD.

The subscription result for HK offering was not good, only around 1.55x oversubscription (margin to offered) ratio. And you can imagine the international offering is even worse.

In fact, the result was very much expected as the ADR price was 178.99/7.75=1387 HKD for 1:1 ratio as highlighted below. This could mean the company CEO Yu Minhong expects more value and popularity of his company; to be a completely subjective opinion of my own.

On Nov 3rd 2020, the syndicate changed IPO issuing price from 1399 to listing at 1190, which was way under the ADR value. Green shoe price was 1180hkd=1,506.5m/1,276,500. The company failed to raise as much capital as intended, but IPO carried on as the underwriters agreed to purchase all the unwanted shares in return for a much lower listing price. All what’s left for the underwriters is managing the position risk. As you probably remember from the movie “Wolf of Wall Street”, underwriters are not allow to do “pump and dump” in very short amount of time, which is heavily regulated now.

Ok now we should have all the information to carry on the analysis:

First consider the scenario where the syndicate went ahead with the original IPO price. Using the green shoe option given, break-even point was 1370 HKD, which is only 2.11% below the listing price. Underwriters lose money if the stock price drops more than2.11. And don’t forget the position risk assumed by one hundredth of the global shares.

Second is the current situation, where listing price is 1190 instead of 1399.

The new break even price is 1188, which is only .168% of the listing price, because it is deemed impossible for the price to drop on IPO date given the spread with ADR. The position risk is also compensated by the extremely low listing price 1190 HKD compare to the 1387 HKD ADR price.

Below are the assumptions I don’t know for sure so subject to unmaterial changes:

- Extra shares the underwriter group was forced to take (assumed to be one hundredth)

- True cost basis for the underwriters is around the same as green shoe price of 1180.

- We don’t know for how long the underwriters are required to hold the shares before unloading.

- Assume the stock is fairly priced at the ADR level.

Eventually the company gave up 11.905–10.126=1.779 billion HKD to have the IPO succeed. Underwriter group gained the fees, and some decent trading profit in compensation for the position risk it had to take for an unclear period of time.

For regular investors, you should never buy overly subscribed IPO.

It is impossible that everyone (institutional investor, company, underwriters, average investors) wins. One way to exploit the current system is as follows.

Know how underwriters evaluation the company. For example in China, people tend to fix PE. However, double check with FCF valuation with competitor WACC, EV/EBITDA or PB ratios to make sure your number is in the range. As company always wants to raise as much money as possible, without regulation, stock can never be undervalued in theory. So look for a wide offering price range that has your number on the high end. Then it is a guaranteed cash-in opportunity when the domestic offering subscription ratio is low. Feel free to let me know if you know how to find out the global oversubscription ratio in the comments!

Thanks for reading!

References:

https://www1.hkexnews.hk/listedco/listconews/sehk/2020/1029/2020102900113.pdf

https://www1.hkexnews.hk/listedco/listconews/sehk/2020/1029/2020102900111.pdf

http://www.iporesults.hkex.com.hk/listedco/listconews/sehk/2020/1106/9503011/2020110600044.pdf

http://asia.blob.euroland.com/press-releases-attachments/1261770/HKEX-EPS_20201103_9499049_0.PDF

http://www.iporesults.hkex.com.hk/listedco/listconews/sehk/2020/1106/9503011/2020110600043.pdfDF